COURT FINDS EMPLOYER’S GOOD FAITH BELIEF RELIEVES EMPLOYER OF PENALTIES

California Labor Code Section 226 has long required that employees be provided with detailed wage statements every pay period. The Labor Code also provides that the “knowing and intentional” failure to do so can result in the imposition of penalties of $50.00 for the pay period in which the initial violation occurs, and $100 penalty per employee for each subsequent violation, up to $4,000 for each employee, plus attorney’s fees.

Until now, there has been no guidance on what a court would consider to be a “knowing and intentional failure” to justify the imposition of the penalties or what defense an employer could assert to avoid the imposition of the penalties.

Until now, there has been no guidance on what a court would consider to be a “knowing and intentional failure” to justify the imposition of the penalties or what defense an employer could assert to avoid the imposition of the penalties.

In the recent California Supreme Court decision in Naranjo v. Spectrum Security Services, Inc., the court accepted the employer’s assertion of a ”good faith” defense to Section 226 wage statement penalty claims. The Court found that the intent of Section 226’s penalty provision is to avoid penalizing an employer who reasonably and in good faith disputes that it is required to report certain amounts as wages.

Reasonable, Good Faith Belief at Issue

In the Naranjo case, the California Supreme Court addressed the fact that in prior cases, courts have declined to enforce penalties when defendants have a good faith — albeit incorrect — belief that their actions were in compliance with legal requirements. The Court stated that this is because penalties (as opposed to damages) are not to compensate the plaintiff, but to punish a defendant for wrongdoing and deter them from acting improperly in the future. A defendant who reasonably believed they were acting lawfully requires no deterrence, so imposition of a penalty is unnecessary.

Applying this standard, the court held the defendant would not be subject to penalties for “knowing and intentional” violations of section 226 because the employer reasonably and in good faith believed that its position was correct.

Additionally, the court noted it wasn’t until 2022 that it held that penalty pay constituted “wages” and had to be included on wage statements at all. It stated that the employer’s actions from 2004 to 2007 should not be interpreted as intentional violations of a ruling that it wouldn’t issue for 15 years.

In light of the court’s ruling, employers can now assert a defense to certain wage and hour claims that they acted reasonably and in good faith. If the employer’s actions support a good faith finding, penalties can be avoided.

WAGE AND HOUR AUDITS ARE KEY TO AVOIDING LIABILITY

Employers would be well advised to conduct annual audits of their wage and hour practices to ensure that they are in compliance and also can argue that they had a reasonable good faith belief that they were compliant. Areas to audit include:

Employers would be well advised to conduct annual audits of their wage and hour practices to ensure that they are in compliance and also can argue that they had a reasonable good faith belief that they were compliant. Areas to audit include:

Employee Classifications: The proper classification of employees is critical in avoiding potential liability for missed meals, missed breaks, overtime compensation, and record keeping, to name just a few.

First, the default classification should be non-exempt. All employees, no matter their position within the company, can be hourly/non-exempt. It is important to know that simply paying an employee a salary, even if the employee themselves request that form of compensation, does not guarantee compliance.

Employee should only be classified as exempt if they meet the 2 step test – the duties test AND the salary basis test. The salary test is easy – do they earn at least twice the California state minimum wage rate annualized. (e.g. For 2024 this is $16.00 per hour X 2,080 hours/year X 2 = $66,560.)

The duties test must be carefully evaluated to determine if the employee falls within one of the exemptions – the employee’s specific job duties must be reviewed to determine how the employee actually spends their time. Employees classified under the executive, administrative or professional exemption must spend more than 50 percent of their time engaged in duties that qualify as “exempt.”

If both the duties and salary tests are not met, the employee must be treated as non-exempt.

Worker Classification: Another huge area of potential risk is misclassifying a worker as an independent contractor. Over the past few years, California has enacted several pieces of legislation and several court decisions have changed the concept and ability to classify a workers as an independent contractor.

A misclassification creates risk of potential liability for failure to comply with wage and hour laws for employees – this includes paying minimum wage, paying overtime, providing meals and breaks, providing wage statements, to name just a few.

Employers should assume all workers are employees unless the worker clearly meets the legal requirements for classification as an independent contractor- e.g. the “ABC Test” as detailed in the Labor Code.

Audit Timekeeping and Pay Practices:

Audit Timekeeping and Pay Practices:

Time Rounding: Rounding of time has been disfavored by the courts because of the advances in time keeping systems so employers should discontinue any “rounding” practices.

Accurate Records: If an electronic system is used, the time records should be accurate to the minute. If an employee is maintaining a manual time record, the time must also be accurate – and not the exact same entry for every single day. The time records should record the actual “hours worked” – to include the time that employees begin and end work, as well as the start and end of their meal breaks.

Under California law, “hours worked” is defined as time that an employee is “suffered or permitted to work” or is subject to the employer’s control — even if the employee is not actually performing work. Employees should be advised that they are not to engage in any work related activities before or after their shifts. Additionally, if you require employees to put on or take off uniforms or safety equipment, the time should be paid.

Regular Rate of Pay: As is well known, overtime in California is paid for hours in excess of 8 per day and 40 hours per week. What many employers fail to realize is that overtime hours must be paid using an employee’s “regular rate of pay”,” which is not always the same as the employee’s standard hourly rate.

If an employee receives compensation other than a single hourly wage — such as multiple hourly rates, commissions, shift differentials or non-discretionary bonuses — that additional compensation will likely need to be factored into the regular rate of pay. (Missed meal and Rest Break premium and paid sick leave is also to be paid at the regular hourly rate.)

Timing of Wages: An issue applicable to all employees is the timing of wage payments both during employment and at separation.

During employment, wages must be paid at least twice a month on a designated payday.

Employees who have been terminated or laid off must be paid at the time of termination – including final wages and any earned but unused vacation/PTO. For employees who resign, they are to be provided their final wages within 72 hours of notice of their resignation (which is 72 consecutive hours including weekends).

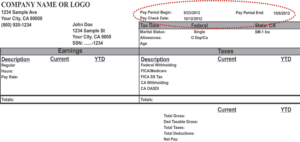

Wage Statements: California law requires that employers provide employees with accurate wage statements either as part of their paycheck or in a separate document. The wage statement must contain specific information, including:

- Gross wages earned in the pay period.

- Total hours worked in the pay period (not applicable to exempt employees).

- All deductions, including taxes, disability insurance and health and welfare payments.

- Net wages earned in the pay period.

- The pay period’s inclusive dates (meaning the start and end of the pay period).

- Name of the employee and last four digits of their Social Security number (SSN).

- All employers can print no more than the last four digits of an employee’s Social Security number on check stubs or similar documents. They can substitute some other identifying number.

- The full legal name and address of employer or legal entity that is the employer (if the employer is a farm labor contractor, the wage statement must include the name and address of the legal entity that secured the services of the employer).

- All applicable hourly rates in effect during the pay period and the corresponding number of hours the employee worked at each hourly rate.

- The number of piece rate units earned and any applicable piece rate, if the employee is paid on a piece rate basis.

Even the smallest error or omission of required information on a wage statement can give rise to penalties, so full compliance is critical.

Employers should carefully review and audit their payroll practices to ensure compliance and take steps to correct any deficiencies to avoid potential liability. Please feel free to contact our office to assist with your Compliance Audits.

This Newsletter is intended as a brief summary of employment law. While every effort has been made to ensure the accuracy of the information contained herein, it is not intended to serve as “legal advice,” or to establish an attorney-client relationship. If additional information is needed on any of the topics contained herein, please contact our office. All rights reserved. ©2024.